PlanB on Bitcoin Math & Value – The Investor’s Podcast, Hosted By Preston Pysh and Stig T. Brodersen (podcast & notes)

Listen to the podcast: We Study Billionaires – The Investor’s Podcast Network – Episode 260 – Bitcoin Math & Value – w/ Plan B

The following is a summary from the podcast provided by podcastnotes.org. Follow along while you listen.

Key Takeaways

- Because of its supply cap of 21 million coins, Bitcoin is the first scarce digital object the world has ever seen

- One can describe the scarcity of a commodity in terms of its Stock-to-Flow (SF) ratio

- Bitcoin currently has an SF ratio of 27

- The SF ratio of all commodities is correlated with their market value

- Gold currently has an SF ratio of 55 and a market value of $10 trillion

- Bitcoin

halving is a significant event (every ~4 years, or 210,000 blocks, the

supply rate of new coins is halved) – this doubles its SF ratio and

increases Bitcoin’s value

- The next halving in May 2020 will increase its value by 8-10x, resulting in an estimated Bitcoin price of $50,000-100,000

- The halving in 2024 will double Bitcoin’s SF ratio again to 100 (something humanity has never seen before), resulting in a Bitcoin price of ~$400k – 1MM

- A futures market settled in Bitcoin will make investors cautious shorting Bitcoin

- If the price goes up, they will need to deliver physical Bitcoin, not just put up more cash

- Bitcoin has a Sharpe ratio above 1, which indicates the average risk is smaller than the average return

- “If you invested just 1% of your portfolio in Bitcoin and let the other 99% do nothing—if you kept it cash, or something similar— that would have outperformed the S&P 500 over a 4-year period for all years in the past 6, 7, or 8 years” – PlanB

- If Bitcoin proves to be inversely correlated with traditional assets during a financial crisis, it’ll make it an undeniable safe-haven asset

Books Mentioned

- In The Bitcoin Standard, author Saifedean Ammous describes the scarcity of a commodity in terms of its Stock-to-Flow (SF) ratio

Resources Mentioned

- The Bitcoin whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System

- The Stephan Livera and What Bitcoin Did podcasts

- “I never listened to a podcast before Bitcoin—now I listen to a Bitcoin podcast every day in the car” – PlanB

- Hive.one has a list for the most respected Bitcoin authorities (make sure you follow the right people)

Intro

- PlanB (@100trillionUSD) is an anonymous quant known for his statistical work on the Stock-to-Flow analysis of Bitcoin

- Check out PlanB’s article: Modeling Bitcoin’s Value with Scarcity

- Hosts – Preston Pysh (@PrestonPysh) and Stig T. Brodersen (@stig_brodersen)

How PlanB Got Into Bitcoin

- PlanB is currently based in Amsterdam where he works for a multi-billion dollar international fund focused on traditional assets

- He became interested in Bitcoin because of its supply cap of 21 million coins; it’s the first scarce digital object the world has ever seen

- Surely, this digital scarcity has value, but how much? – To find an answer, PlanB decided to apply his expertise to perform solid statistical econometric analysis

Valuing Bitcoin Based on its Stock-to-Flow Ratio

- In The Bitcoin Standard,

author Saifedean Ammous describes the scarcity of a commodity in terms

of its Stock-to-Flow (SF) ratio; if you’re unfamiliar with

Stock-to-Flow:

- The Stock (S): the existing supply of a commodity

- The Flow (F): extra production in the next period

- Stock-to-Flow: How much extra is produced compared to existing stockpiles – (S/F)

- Currently, Bitcoin has a stock of 18,000,000 coins and a yearly flow of 750,000 new coins—an SF ratio of 27

- PlanB discovered the Stock-to-Flow ratio of all commodities is correlated with their market value

- For instance, the SF ratio of gold is 55 and its market value is $10 trillion

- “If

you plot the SF ratio of all commodities against their values, you get a

straight line—it’s actually a power law with super high R2 correlation” – PlanB

- If you’re unfamiliar with R2, it measures the quality of fit for a model on a 0-100% scale

- PlanB applied two models to test the correlation between Bitcoin’s Stock-to-Flow ratio and price:

- The cross-asset model, which resulted in an R2 value of 99.5%

- “It’s amazing; I have never, ever seen that before” – PlanB

- The time series model, which resulted in an R2 value of 95%

- These above values indicate Bitcoin’s price is closely linked to the halving function (discussed below)

- The cross-asset model, which resulted in an R2 value of 99.5%

The Bitcoin Halving Function

- The halving is a significant Bitcoin event: The supply rate of new coins is halved every 210,000 blocks (roughly every ~4 years)

- This halving doubles the Stock-to-Flow ratio and increases Bitcoin’s value

- Currently, Bitcoin has an SF ratio of 27 – the model estimates the price to be little under $10,000 per bitcoin

- The next halving in May 2020 will increase its value by 8-10x, resulting in an estimated Bitcoin price of $50,000-100,000

- The halving during 2024 will double the SF again to 100, resulting in a Bitcoin price of ~$400k – 1MM

- A Stock-to-Flow ratio of 100 is something humanity has never seen before. and is made possible with a decentralized/fixed supply of a digital token

- Preston comments that you can keep mining more gold out of the ground, but with Bitcoin, its absolute scarcity, thus tightening the halving function

- “People underestimate the speed at which this is going; [Bitcoin’s] SF ratio will double to near gold levels after May 2020, which means the market cap of Bitcoin will be in the trillions of dollars—$1-2 trillion, compared to the USD monetary base of $3 trillion. That’s an order of magnitude in the same range. In 2024, [assuming Bitcoin’s] SF ratio doubles to 100, its market cap will be in the $10-20 trillion range, way above the USD, which has all kinds of implications.” – PlanB

Bitcoin’s Path to a $10 Trillion Dollar Market Cap

- Hitting the $10-20 trillion market cap will change what people use as a unit of account—it wouldn’t make sense to price things in dollars anymore

- Bitcoin’s current market cap is only $150 billion, compared to $500 trillion for derivatives and $200 trillion for bond markets

- Many traditional markets (like stock and real estate markets) have a monetary premium beyond the fundamental value they hold; they’ll likely lose that premium to the asset that captures and holds it best (Bitcoin)

The Implications of a Bitcoin Futures Market Settled in Bitcoin

- Derivatives are important—they allow for more liquid

markets that attract bigger institutional investors. Bitcoin has several

big futures markets.

- A futures contract lets you buy and sell bitcoins at a predetermined price at a specified time in the future, settled in the future

- CME Bitcoin futures are settled in cash – you could theoretically sell more than 21 million bitcoins, even if they don’t exist

- Bakkt Bitcoin futures are settled in physically delivered bitcoins – to sell bitcoins, you need to actually have them (and that changes the whole game)

- There can be arbitrage between Bakkt and CME, and investors will be more cautious shorting Bitcoin

- If the price goes up, they’ll need to deliver those bitcoins—it’s not a matter of putting up more fiat

The Significance of the Sharpe Ratio When Investing in Bitcoin

- Bitcoin has a Sharpe ratio above 1, which indicates the average risk is smaller than the average return; this is hard to see in assets

- Bitcoin’s average return is above 200% per year, while the worst loss is 80%

- (The Sharpe ratio is a measure of risk-adjusted return)

- Using the Kelly Criterion, just like in poker, you size your bet depending on your odds

- “If you invested just 1% of your portfolio in Bitcoin and let the other 99% do nothing—if you kept it cash, or something similar— that would have outperformed the S&P 500 over a 4-year period for all years in the past 6, 7, or 8 years” – PlanB

- Ray Dalio explains how his investing revolves around two principles:

- Finding something with a very high Sharpe ratio

- Mixing it with 10-15 uncorrelated positions that also have high Sharpe ratios

Bitcoin Has Yet to Be Tested By a Financial Crisis

- Bitcoin was invented in 2009 as a response to the 2008 financial crisis

- Inverted

yield curves and other measures are pointing to an incoming

recession—this will be the time to test Bitcoin for negative correlation

with other assets

- If Bitcoin proves to be inversely correlated with traditional assets during a financial crisis, it’ll make it an undeniable safe-haven asset

- “The negative interest on $17 trillion dollars worth of bonds together with quantitative easing is the reason I’m in Bitcoin” – PlanB

- PlanB mentions the IMF report proposing deep negative interest rates (-5 to -10%)

- Negative-yielding bonds mean that buyers holding the securities to maturity are guaranteed to make a loss

- Preston explains that making a profit on a negative-yielding bond means buyers expect the interest rates to go even lower; the only way to make money is by finding a greater fool willing to take an even bigger loss—it’s the definition of the greater fools theory of investing (a Ponzi scheme)

- Most investors are starting to see the unsustainability of this and more will hedge against it with Bitcoin

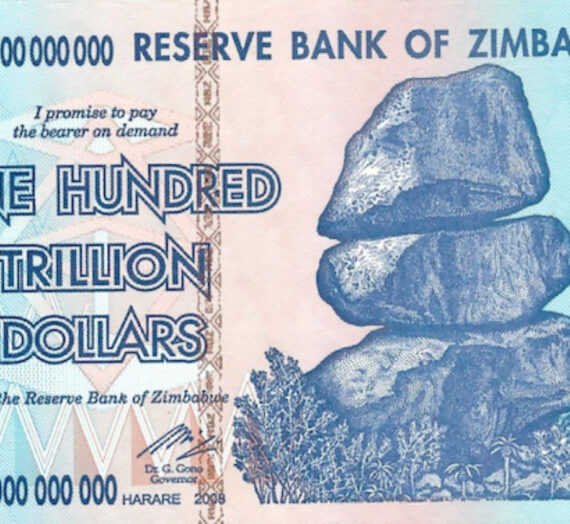

Hyperinflation & Bitcoin:

- The 1920s collapse of the German Mark against gold is the most famous example of hyperinflation – PlanB published a chart comparing it with Bitcoin’s USD price

- A coalition of smaller countries is most likely to adopt Bitcoin

- The U.S. has too much to lose by giving up its reserve currency status; this is similar to Germany, who has too many exports to make the jump

- Bitcoin is the solution in the Triffin dilemma, but only if everyone works together

How should investors educate themselves about Bitcoin?

- (With the resources mentioned above)

- PlanB is amazed by

the level of misunderstanding in the traditional investment field – this

reminds him of the Nobel Prize-winning Black-Scholes Model invented in 1973 for pricing options

- The model was in public for 10 years but wasn’t understood or exploited – it’ll probably be the same with the Stock-to-Flow model

- Why did Satoshi

leave? – If you research and come to know the answer to this question,

you’ll protect yourself against a lot of scammers, misunderstanding, and

misinformation.

- “Why is it important NOT to have a leader—no CEO, no corporation, no government, no pre-mine? If you understand why that is, and why you only need a peer-to-peer network governed by a mathematical protocol and some energy to protect it, you know the answers to a lot of things in Bitcoin.” – PlanB

Ask The Investors: Should I invest in China?

- Stig explais it’s important to not overestimate the effect of the rise of China on US stock investors

- Stig and Preston agree you could get exposure by buying a Chinese ETF tracking the stock index. But keep in mind:

- The risk of investing in a country with very different regulations from the west

- It can have expensive management fees and can have other risks

- If you’re feeling adventurous and want to focus on individual companies, focus on three things:

- Find a company that originated in China

- Look for companies that have a fairly large market cap with room to grow

- Look for companies that have government leadership entrenched within them, such as Tencent and Alibaba

- Stig personally owns Alibaba stock as a bet on e-commerce in China in general, but he doesn’t recommend investing for China for its own sake

- Preston doesn’t personally have any investments in China.

Special thanks to Podcast Notes (see their original podcast transcript)